per capita tax definition

Medium-high-income countries GNI per capita 3996 to 12375 per year. Define Per capita payment.

Azerbaijan Gdp Per Capita Current Dollars Data Chart Theglobaleconomy Com

Income per capita is a measure of the amount of money earned per person in a certain area.

. A share wont be created for the deceased beneficiary and all the other beneficiaries shares will be increased accordingly if one of the identified group is deceased. Per capita fees are per-head fees charged on livestock. Income per capita is the average earnings per person in a geographic region such as a city state or country.

It means to share and share alike according to the number of individuals. Due to return processing delays relating to the erroneous assertion of self-employment tax on per capita distributions to tribal members the Service has developed a solution which involves wording that must be entered on Line 21 of Form 1040. It can apply to the average per-person income for a city region or country and is used as a means of.

The school district as well as the township or borough in which you reside may levy a per capita tax. Normally the Per Capita tax is NOT. Both taxes are due each year and are not duplications.

What is the Per Capita Tax. Total tax revenue as a percentage of GDP indicates the share of a countrys output that is collected. Means that as- pect of a plan which pertains to the in- dividualization of the judgment funds in the form of shares to tribal members or to individual descendants.

Tax revenue is defined as the revenues collected from taxes on income and profits social security contributions taxes levied on goods and services payroll taxes taxes on the ownership and transfer of property and other taxes. Is this tax withheld by my employer. Per capita tax A per member assessment usually by a parent body that unions must remit periodically.

Prepared by the author with data from the IMF. Per Capita means by head so this tax is commonly called a head tax. Per Capita Latin By the heads or polls A term used in the Descent and Distribution of the estate of one who dies without a will.

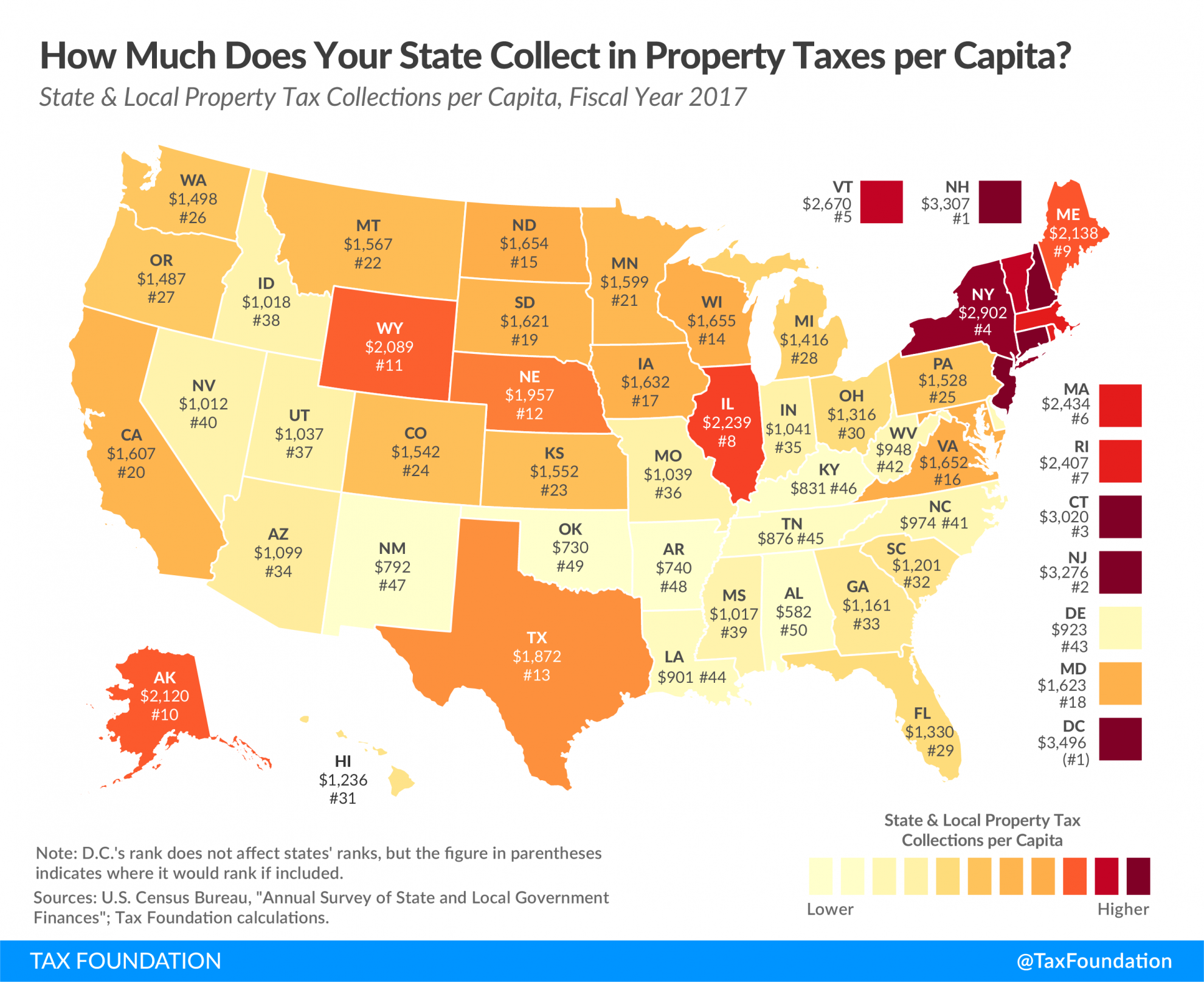

Per unit of population. Learn how to define income. The highest state and local property tax collections per capita are found in the District of Columbia 3740 followed by New Jersey 3378 New Hampshire 3362 Connecticut 3107 New York 3025 and.

Per capita Unit Number of people in a population. 58 countries High-income countries GNI per capita greater than 12376 per year. B Each local taxing authority may by ordinance or resolution exempt any person whose total income from all sources is less than twelve thousand dollars 12000 per annum from the per capita or similar head tax occupation tax or earned income tax or any portion thereof and may adopt regulations for the processing of claims for exemptions.

Presbyterians have used per capitaan annual per member apportionment assessed by the General Assembly Book of Order G. On average state and local governments collected 1675 per capita in property taxes nationwide in FY 2018 but collections vary widely from state to state. By or for each individual a high per capita tax burden.

The Center is a joint venture of the Urban Institute and Brookings. Receipt A document which the union provides to confirm that money has been collected or which a vendor provides to confirm that goods or services have been provided to the union. It is not dependent upon employment.

In these days of diminishing resources and tight budgets the Presbyterian Church USA continues to seek new and innovative ways to provide ministry and support to mid councils presbyteries and synods across the country. New York has the highest per capita local general revenue from its own sources at 5463 while Vermont has the lowest at 1230 per capita. New Jersey has the highest per capita state property tax revenue at 2918 while Arkansas has the lowest at 319 per capita.

The Per Capita Tax is levied upon all residents of the School District age 18 years or older under the authority of the Legislature of the Commonwealth of Pennsylvania ACT 511 of 1965 and Section 479 of the Pennsylvania School Code. Do I pay this tax if I rent. A Per Capita tax is a flat rate tax equally levied on all adult residents within a taxing district.

Authorized by Montana Code Annotated 15-24-921 per capita fees are assessed on all poultry and honey bees all swine three months of age or older and all other livestock nine months of age or older The fees help fund the departments animal health programs brands enforcement theft. ISSUE This report shows how Connecticut ranks among the states on net-tax supported debt NTSD per capita and summarizes recent state efforts to increase their capacity to afford debt. For most areas adult is defined as 18 years of age and older though in some areas the minimum age may differ.

Calculating per capita entails taking into account a measurement or number amount by which you will then divide by the total population of the group wishing to be analyzed. Connecticut s NTSD per capita in 2014 was 5491 which ranked Connecticut first among the states based on this debt affordability measure according to Moody s Investors. 60 countries We analyze the relationship between tax burdens and per capita income separately for each group of countries.

In a per capita distribution an equal share of an estate is given to each heir all of whom stand in equal degree of relationship from a decedent. Per Capita Tax is a tax levied by a taxing authority to everyone over 17 years of age residing in their jurisdiction. Whether you rent or own if you reside within a taxing district you are liable to pay this tax to the district.

The following formula can be used to determine the per capita. Per capita is Latin for by head All the living members of the identified group will receive an equal share if the beneficiaries are to share in a distribution per capita. The Per Capita Tax is a flat rate local tax payable by all adult residents living within a taxing jurisdiction.

/dotdash_Final_Gross_National_Income_GNI_May_2020-01-53d357d45bae47f29d3c72a98f190f8d.jpg)

Gross National Income Gni Definition

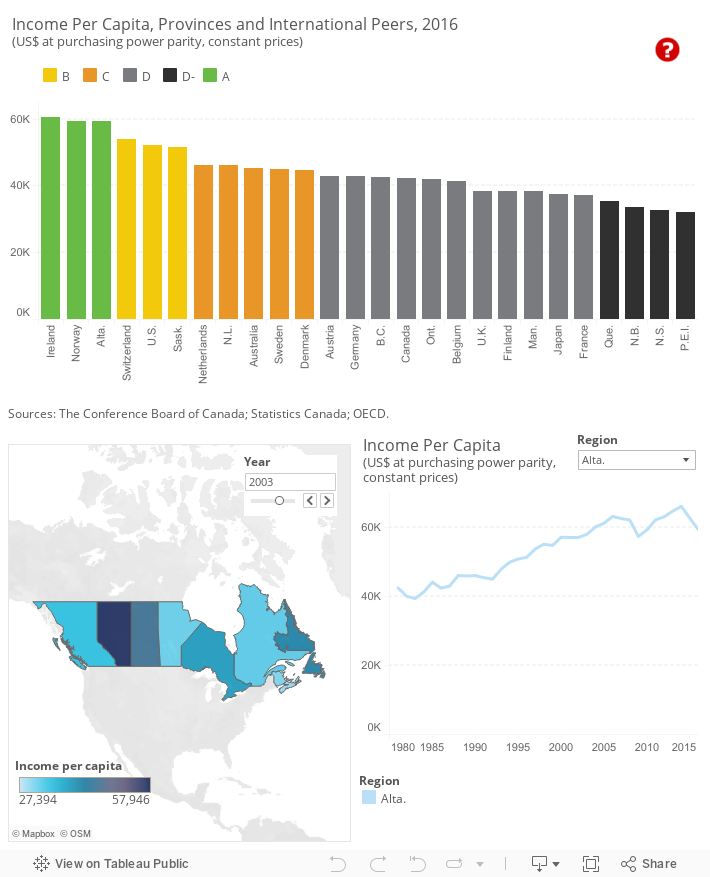

Income Per Capita Economy Provincial Rankings How Canada Performs

Tax Base Definition What Is A Tax Base Taxedu

/GettyImages-1301491715-e74fda1402e6477a9477bff256370b83.jpg)

What Is Fiscal Policy Definition And Examples

Top 20 Lowest Gdp Countries 2017 Statista

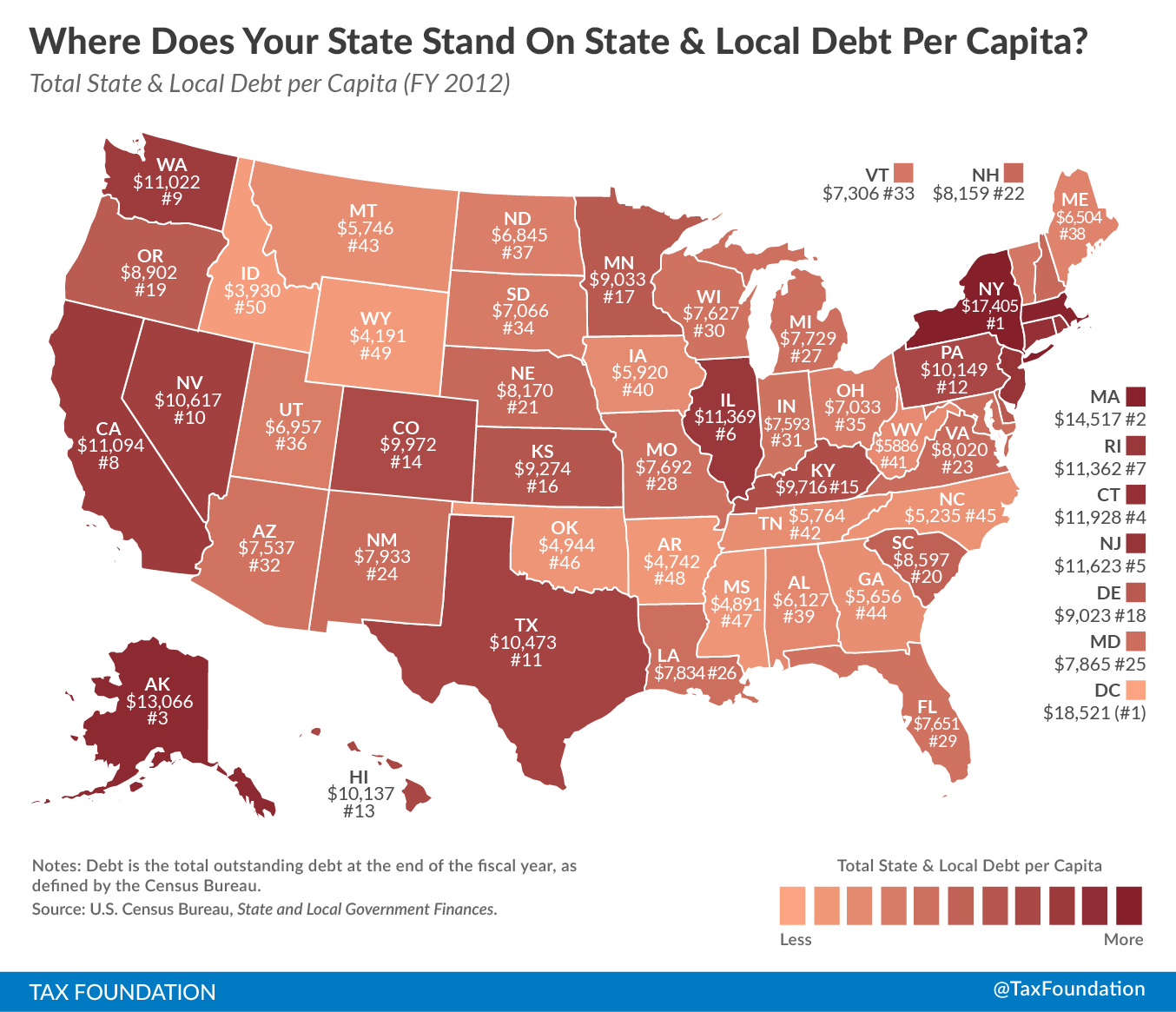

Where Does Your State Stand On State Local Debt Per Capita Tax Foundation

Income Per Capita Economy Provincial Rankings How Canada Performs

Benin Gdp Per Capita Constant Dollars Data Chart Theglobaleconomy Com

Property Tax Definition Learn About Property Taxes Taxedu

/dotdash_Final_Gross_National_Income_GNI_May_2020-01-53d357d45bae47f29d3c72a98f190f8d.jpg)

Gross National Income Gni Definition

Key Aspects Of Per Capita Personal Income

Property Tax Definition Learn About Property Taxes Taxedu

Mozambique Gdp Per Capita Ppp Data Chart Theglobaleconomy Com

Information About Per Capita Taxes York Adams Tax Bureau

Per Capita Definition Formula Examples And Limitations Boycewire

/GettyImages-545863985-e964b845dce944dfb2b94153aab83a7a.jpg)